EXECUTIVE SUMMARY

After a multi-year period of missed expectations, the International Monetary Fund (IMF) now projects annual gross domestic product (GDP) in emerging market (EM) countries to accelerate every year until 2021 while developed markets are expected to decelerate from 2018. This positive change in growth trajectory for EM countries, in combination with the significant underweight from global investors and positive company and country specific momentum stories, should translate into a re-rating for the asset class as we step into this next investment cycle. Overall, we expect EM to continue outpacing developed market equities on account of stronger momentum, higher growth rates, attractive valuations, and positioning. We take a constructive view on the EM equity asset class and see a strong opportunity for the second half of 2017 and beyond.

KEY EVENTS &Trends

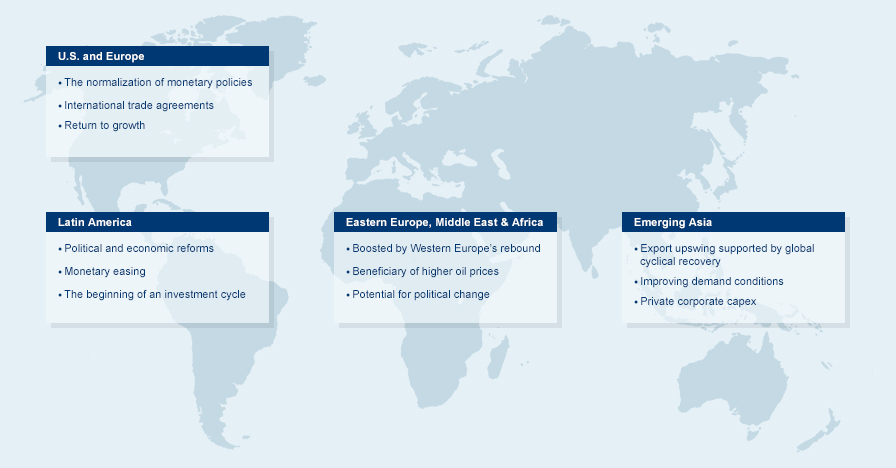

- Political Events & Central Banks: The second half of 2017 will be marked by leaders in the US and Europe trying to push through their agendas along with actions from the world’s key central banks. While the US continues to raise rates, signaling a healthy US economy, other regions will diverge in their interest rate cycles.

- China's Soft Landing: The delicate balance between China’s sound economic figures and the government’s tightening policies will likely have global repercussions. Not only does this impact global trade, but it also has a large effect on commodity prices.

- EM vs. DM Differential: EM equities are coming from an extremely low base and global investors are still underweight the asset class. This has led to a discount in valuation vs. DM counterparts. We believe this is counterintuitive given the growth outlook for EM countries relative to DM counterparts.

CONTACT US