EXECUTIVE SUMMARY

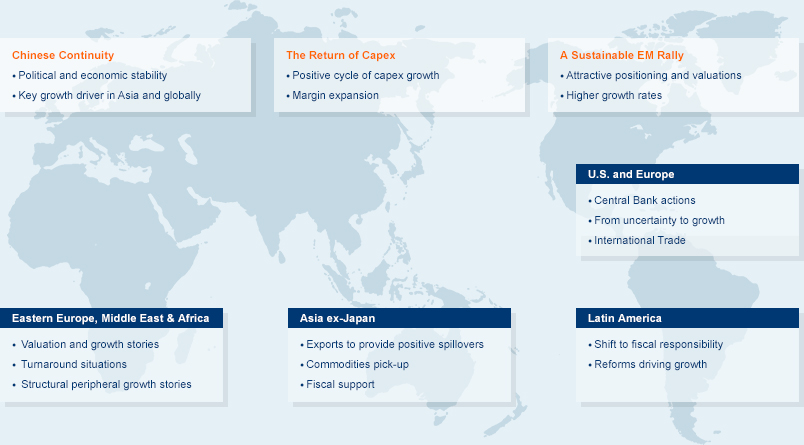

We believe that emerging market (EM) equities are in the early stages of a multi-year recovery and are optimistic about continued EM outperformance vs. developed markets (DM) in 2018 and beyond. Looking to 2018, we are paying close attention to political continuity and economic stability in China, the start of a new global capital expenditure (capex) cycle, and attractive positioning and valuations for the EM equity asset class.

KEY EVENTS & TRENDS

-

A Sustainable Rally in EM: We believe that EM equities are in the early stages of a multi-year run. Looking back to the mid-1970s, we have seen six EM bull cycles. On average, those cycles have lasted 42 months and delivered 228% returns in USD.1 As the current EM run has started less than 24 months ago and delivered only roughly a 45% USD return,2 we gain comfort with our thesis that EM equities still have a significant re-rating period ahead of them.

1. Bank of America Merrill Lynch, September 2017

2. Bloomberg, 11/30/2015-10/31/17 - Chinese Continuity: We maintain the view that China is not heading into a hard landing scenario and will continue to be a key growth driver for Asia and globally. China’s drive to deleverage will likely continue and should have a limited negative impact on growth. We expect the process to be gradual and policymakers will adjust accordingly if growth slows too much or if market conditions change.

- The Return of Capex: After almost half a decade of declining global corporate capex growth translating into negative demand for EM exporters, capex growth has pivoted back to a positive cycle. This change should help drive sustainable growth in 2018 and beyond as capex-led GDP growth tends to correlate with foreign inflows and a re-rating of asset prices.

CONTACT US

* Direct Email Address : ContactUs.Global@miraeasset.com